Asset Disposal Journal Entry

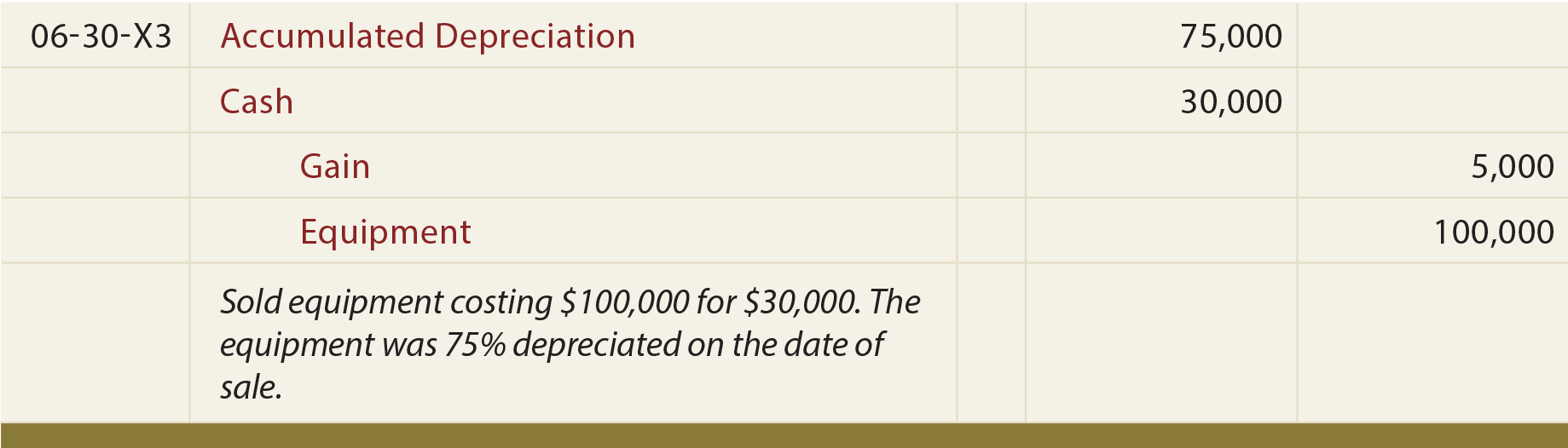

This gain on disposal is recorded by making following journal entry. Enter the date and a reference for the journal.

Journal Entries For Retirements And Reinstatements Oracle Assets Help

Asset disposal requires that the asset be removed from the balance sheet.

. Since the asset had a net book value of 3000 the profit on disposal is calculated as follows. Profit on disposal Proceeds - Net book value Profit on disposal 4500 - 3000 1500 The fixed assets disposal journal entry would be as follow. The journal entry you make depends on whether the asset is fully depreciated and whether you sell it for a profit or loss.

Disposal account 105000 Credit. Enter the relevant information to record the disposal of the old asset and clear your depreciation for example. We are an Open Access publisher and international conference Organizer.

Show how the journal entry for the depreciation expense will be recorded at the end of the accounting period on December 31 2018. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. We usually make the disposal of the fixed asset that is fully depreciated by completely discarding it when it has no residual value at the end of its useful life.

Otherwise its not considered to be some logical analytic. The fixed assets journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of fixed assets. Sale of an asset may be done to retire an asset funds generation etc.

A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1. This lets us find the most appropriate writer for any type of assignment. 98 of production comes from offshore fields.

To use the same example ABC Corporation gives away the machine after eight years when it has not yet depreciated 20000 of the assets original 100000 cost. The cost to sell it would be 10000. Accounting for Disposal of Fixed Assets.

Must recognize the gain from the sale. There is a common misconception that depreciation is a method of expensing a capitalized asset. Journal entry for recording repair and maintenance expenses.

Starting from when Ed sends us the invoice this is how we will book the journal entries at each stage in the process. Below is the journal entry for disposal of fixed assets with zero net book value. An ISACA Journal volume 5 2016 article titled Information Systems Security Audit.

Therefore it represents the difference between that value and the assets carrying value. The accounting treatment of disposal of asset that is carried on revaluation basis is not very different from the disposal of asset that is carried on historical cost basis. Asset disposal is the removal of a long-term asset from the companys accounting records.

Disposal indicates that the asset will yield no further benefits. Cost of the asset. Fixed Asset Sale Journal Entry Overview.

Enter a description if needed. The oil and gas industry in the United Kingdom produced 142 million BOE per day in 2014 of which 59 was oilliquids. An Ontological Framework 2 briefly describes the fundamental concepts owner asset security objectives vulnerability threat attack risk control and security audit and their relationships to the whole security audit activitiesprocess.

Throwing Giving it away. Read more its expected useful life and its probable salvage value at the time of disposal. A debit increases the cash account which is an asset account.

We own and operate 500 peer-reviewed clinical medical life sciences engineering and management journals and hosts 3000 scholarly conferences per year in the fields of clinical medical pharmaceutical life sciences business engineering and technology. If the asset is fully depreciated you can sell it to make a profit or throw give. In the final part of the question the asset is sold for 4500.

Lets consider the same situation as in scenario 2 but the selling price was only 500. IAS 36 defines the recoverable value of an asset as the higher of its fair value fewer costs of disposal and its value in use. In this situation write off the remaining undepreciated amount of the asset to a loss account.

In the above example the equipment could be sold today for 500000. The journal entry for the disposal should be. Disposal by Asset Sale with a Loss.

Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. The cost of an asset includes all the costs needed to get the asset ready for use. After the assets useful life is over you might decide to dispose of it by.

In business the company may decide to dispose of the fixed asset before the end of its estimated life when the fixed asset is no longer useful due to it has physically deteriorated or become obsolete. The journal entry for this disposal is straightforward. Debit cash for 40000 in a new journal entry.

In each case the fixed assets journal entries show the debit and credit account together with a brief narrative. How Do We Book this Journal Entry. Commonly impairment describes a significant reduction in a fixed assets recoverable value.

Adjust the value in use by the cost of disposal or the amount for which it can be sold at the end of its useful life. Alternatively if the company can sell the fixed asset for some amount even the net book value is already zero it can make journal entry with the selling amount as gain on the disposal of fixed asset. For example assume you sold equipment for 40000.

In 2013 the UK consumed 1508 million barrels per day bpd of oil and 2735 trillion cubic feet tcf of gas so is now an importer of hydrocarbons having been a significant exporter in the 1980s and 1990s. Removing the fixed assets from the balance sheet and. A significant decline in the repair and maintenance expense can be justified when there is substantial disposal of the machinery.

In this case it is simply the removal of such fixed asset from the balance sheet. Journal entry for disposal of asset fully depreciated Fully depreciated asset without residual value. The fixed asset sale is one form of disposal that the company usually seek to use if possible.

When we receive the invoice we need to record the purchase of a fixed asset on the balance sheet. In the case of profits a journal entry for profit on sale of fixed assets is booked. As the fixed asset is fully depreciated thus the company needs to derecognize the assets from its Balance Sheet.

Once an asset is used it depreciates over the useful life. Likewise journal entry for sale of asset fully depreciated will have two entries eg. Nowadays businesses sell their assets as part of strategic decision-making.

Depending on the value of the asset a company may need to record gain or loss for the reporting period during which the asset is disposed. The disposal of fixed assets with zero net book value is also called discarding assets. Go to Adjustments Journals and click New Journal.

The Emergency Economic Stabilization Act of 2008 often called the bank bailout of 2008 was proposed by Treasury Secretary Henry Paulson passed by the 110th United States Congress and signed into law by President George W. Such a sale may result in a profit or loss for the business. A variation on the first situation is to write off a fixed asset that has not yet been completely depreciated.

BushIt became law as part of Public Law 110-343 on October 3 2008 in the midst of the financial crisis of 20072008It created the 700 billion. Record the expense on income statements. Journal Entry for Gain.

Recording a Journal Entry for Asset Impairment 1. Journal Entry for Profit on Sale of Fixed Assets. Profit or loss account 105000.

Disposal Of Pp E Principlesofaccounting Com

Accounting Entries For Disposal With Part Exchange Youtube

Difference Between Cost Of Goods Sold And Cost Of Services

Disposal Of Pp E Principlesofaccounting Com

0 Response to "Asset Disposal Journal Entry"

Post a Comment